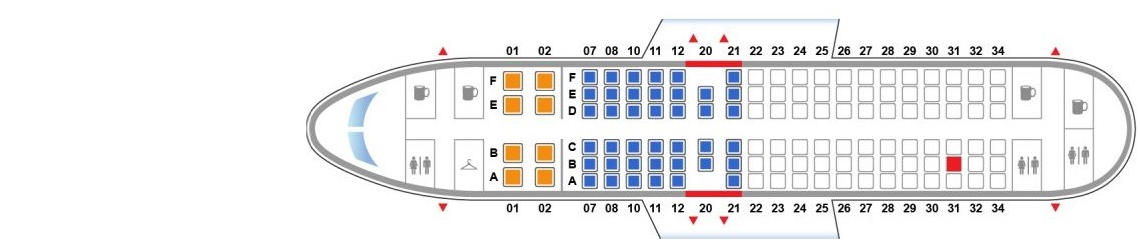

Since its merger with Virgin America, Alaska Airlines has a lot more reach than in the past. It is an airline that has been growing like crazy anyway, and with the addition of the Virgin America network, there are a lot more opportunities to connect than were previously available. This means that if you’re based on the West Coast (or traveling to the West Coast) it’s a lot more practical to use Alaska for cross-country flights than it used to be. Alaska has also added a ton of service to Hawaii and they fly to Costa Rica for good measure. They are also a great airline to fly (and one of my favorites) offering friendly Pacific Northwest hospitality, power at every seat, and free WiFi on every plane.

Eskimo tails are showing up all over the country

One of the great things about Alaska Airlines is the number of partners it has. You’ll see plenty of blog articles extolling the virtues of its Mileage Plan, and I do think that Mileage Plan is pretty good overall. However, it’s not always the best program for booking flights on Alaska Airlines itself. Alaska’s partners sometimes have better award pricing.

Alaska has such a large number of partners that, with one exception, I am focusing on partners to whom you can transfer points. Other partners, such as Hainan and JAL, are primarily useful to people based in their respective local markets.

Programs I Recommend

Alaska Airlines Mileage Plan

While Mileage Plan isn’t always a good deal for Alaska Airlines flights, it sometimes is. For flights on Alaska Airlines, Mileage Plan has two very good sweet spots:

- A stopover is allowed on one-way flights, provided you redeem at the highest 12,500 mile saver award level. This allows you to visit two cities on the same trip with one ticket. I wrote more about how to do this here.

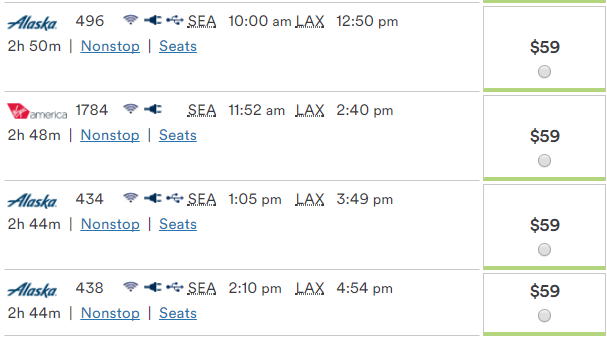

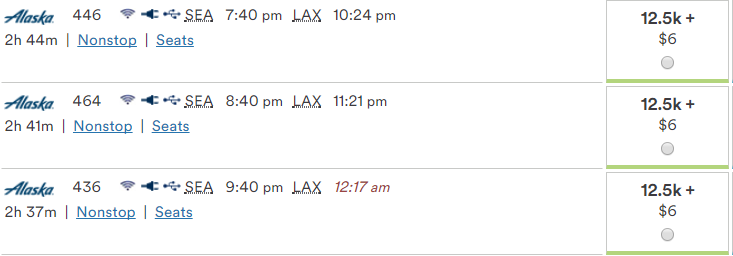

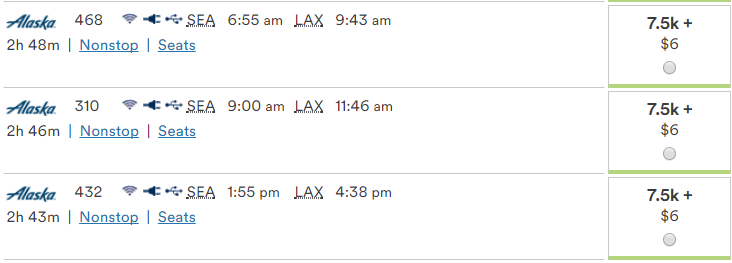

- Short-haul awards, when booked in advance, cost as little as 5,000 miles.

- Domestic US award flights between 1,152 and 1,400 miles start at 7,500 points, versus 10,000 or more points with other programs.

Stopovers are cool, but they have limited utility for most people outside Alaska (where they are sometimes necessary, which is why I think Alaska Airlines still allows them). While it’s fun to add a tag flight to Anchorage onto your award flight from, say, LA to Seattle, it doesn’t really do you much good if you weren’t actually planning to visit there.

The real sweet spot? Almost any other airline program you use is going to charge a minimum of 7,500 points for an award flight on Alaska Airlines, so Alaska Airlines Mileage Plan can be significantly less expensive on short-haul flights. There is a catch, though. Alaska Airlines generally doesn’t give seats away at these award levels when you book at the last minute. You’ll need to book 3 weeks or more in advance.

Another sweet spot is award flights between 1,152 and 1,400 miles. On most award charts, these are more expensive than the 7,500 miles Alaska Airlines Mileage Plan charges. The same advance purchase requirements apply as for short-haul awards.

British Airways Avios

British Airways has a distance based award chart. It’s roughly aligned with Alaska’s distance based award chart, with similar award levels. However, you have to watch out because along with the sweet spots, there are some “sour spots.” For example, the Avios chart is usually more expensive than Alaska Airlines Mileage Plan for flights between 1,152 and 1,400 miles (I say “usually” because Alaska has a variable award chart and charges more for flights booked on short notice).

The program is also quirky in that it charges per flight. This means that if your flight involves a connection, using Avios could make your award much more expensive than in other programs. And a further quirk is that you can’t book Alaska Airlines flights online. Instead, you have to call in, and let’s just say that British Airways doesn’t run the same kind of top-notch call center operation that Alaska does.

Here are the things I think are best about using Avios for Alaska Airlines flights:

- If you don’t have airline status, it’s the cheapest way to book Alaska Airlines flights you want to reserve, but might need to cancel. The cancellation fee is just $5.60 per segment for US domestic flights (for some reason there’s a massive change fee, so it’s cheaper to cancel and rebook).

- The award chart is strictly distance based with no zones or borders. So, for example, you can fly from Los Angeles to Mazatlan for just 7,500 Avios each way. I think that’s far more interesting than the 12,500 Avios from the West Coast to Hawaii that every other blogger beats to death.

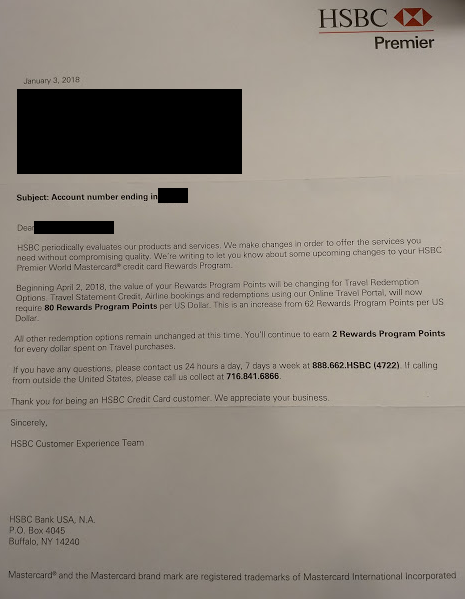

- It’s relatively easy to get Avios. They transfer from HSBC Premier, American Express and Chase along with many hotel programs. There are also lots of bonus opportunities through the Avios shopping portal.

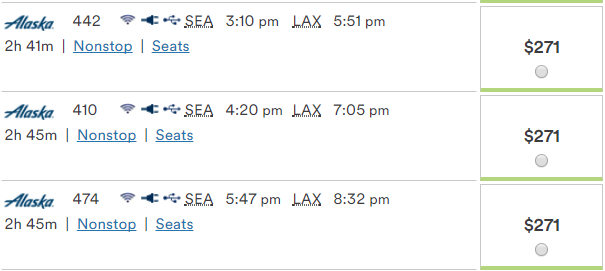

- There are no close-in booking fees and award pricing doesn’t change. It’s the same price if you book 3 hours in advance as it is if you book 3 weeks in advance.

The downside? Awards are a little complicated to book, not searchable online, and availability is limited compared to what Alaska Airlines makes available to their own members. Still, this program is a great way to save points when booking Alaska Airlines flights.

Korean Air Skypass

Hardly anyone writes about using Korean Air Skypass for booking Alaska Airlines flights, and I think it’s probably because almost nobody does it. Also, there is a lot of speculation lately that this partnership will end soon, because Alaska’s relationships with other SkyTeam carriers have ended. Nevertheless, provided you are willing to deal with how much of a hassle this program is, it can be great to use if you’re traveling over a longer distance. Here are the advantages:

- Flights within the US (except for Hawaii) cost 20,000 points roundtrip.

- Flights to Mexico, Hawaii or Costa Rica cost 30,000 points roundtrip.

- A stopover and an open jaw are both allowed.

- There are no close-in booking fees and pricing doesn’t go up close to departure.

A lot of the reasons why round-trip awards are hard to book can be worked around with the generous stopover and open jaw rules. For example, you could fly from Seattle to San Francisco, stop over for a few days, continue to New York, take the train to Philadelphia, then return to Seattle from there. Not only does this allow you to visit 3 cities on a single ticket, but it gives you more options to find award availability.

So, what are the downsides?

- You can only book tickets for yourself and immediate family, and family relationships require a lot of paperwork to prove.

- Award tickets for travel on Alaska Airlines can’t be booked online. You have to book over the phone, and the call center is (to put it politely) difficult to work with. The agents are not native English speakers and they are kept on very strict timers, so try to rush the booking process.

- Only round-trip itineraries are allowed.

- Even though Delta is a Korean Air partner, you can’t mix and match with Alaska flights. You can only fly Alaska Airlines (including Horizon Air and Skywest flights marketed as Alaska).

- Availability is more limited than to Alaska Airlines’ own members.

If you’re traveling over a long distance, though, this program is a no-brainer. 20,000 miles roundtrip from Anchorage to Fort Lauderdale is impossible to beat. It’s even really good for more conventional transcontinental flights such as from Seattle to New York.

It’s also a good deal for flights to Costa Rica when booking from certain regions. These cost 35,000 points when you redeem Korean Air SkyPass miles on Delta, but it’s only 30,000 points when redeeming on Alaska.

Note there is, from some regions, a better “sweet spot” with Costa Rica redemptions using Singapore KrisFlyer. However, this award isn’t available from all zones on their chart whereas there are no zone restrictions using Korean Air Skypass.

Singapore KrisFlyer

Singapore is one of Alaska Airlines’ newest partners. In fact, they are so new that as of this writing, you can’t redeem Alaska Airlines Mileage Plan miles on Singapore flights. Nevertheless, Singapore KrisFlyer members are able to use their miles on Alaska Airlines flights.

The award chart appears to have been created by an intern who has very limited knowledge of US geography. It was obviously rushed out with very little review, because among other things it has invented the states of “North Dakorta,” “Goergia” and “Alsaka.” I was absolutely baffled the first time I saw it. Over time, I’m guessing Singapore will tighten it up, but for the time being, there are some amazing sweet spots. Here’s what I like about the chart:

- One way awards are allowed, and connections en route are (in practice) allowed at no additional charge.

- It’s as easy to get KrisFlyer miles as it is to get Avios. All the same programs apply.

- Costa Rica and most Mexico flights are a crazy value. It’s only 12,000 points each way from most of the West Coast to Costa Rica or Mexico on Alaska Airlines.

- Flying from Canada to Hawaii is only 11,500 points.

- It’s 12,000 points from the West Coast to Hawaii, and only 12,500 points to Hawaii from the Midwest and mid-South. This is an especially good option for people in Dallas where award availability from the former Virgin America mini-hub at Love Field is excellent.

- If you’re based in Dallas, last-minute flights to the East Coast from Love Field are excellent value. The price is the same as Alaska’s own distance-based chart, but it doesn’t go up close to departure.

The downsides:

- The Singapore chart blocks a lot of routes. Las Vegas to Costa Rica? Well, even though you could easily connect in LAX, it’s not an option. The same applies from the East Coast to Costa Rica.

- The Singapore chart is very expensive for short-haul flights to Alaska (such as from Seattle to southeast Alaska). Seattle to Ketchikan can be as little as 5,000 points on the Alaska award chart, but it’s 12,000 on the Singapore chart.

- Intra-Alaska flights are extremely expensive because they cost the same as a flight from Alaska to Hawaii (which, on the other hand, is extremely cheap at just 12.5k miles).

- No stopovers are permitted. Technically, “transfers” are not permitted either, but this seems to only apply to co-terminals (meaning no airport changes are allowed).

- You can’t book Alaska Airlines flights with KrisFlyer miles online. Instead, you have to call in, and dealing with the KrisFlyer call center can be a challenge (to put it lightly).

To me, what is the best sweet spot? Costa Rica. It’s less expensive on the Singapore chart than any other award chart. While the Avios chart can be cheaper to a handful of Mexican destinations from Los Angeles, the Singapore chart beats it hands down if you’re going to or from anywhere else.

Cathay Pacific Asia Miles

While Cathay Pacific has a fairly expensive award chart for most flights on Alaska Airlines, they can deliver equivalent value to Alaska Airlines Mileage Plan if you need to take a trip with a lot of stops. This is because Asia Miles allows you to take up to 5 stopovers on an award, and you can also include two open jaw connections. ** Edit: Technically you’re only allowed 2 stopovers because it’s a non-Oneworld award, but in practice agents have allowed me to do 5. Your mileage may vary.

Here’s an example. You could travel from Los Angeles to Seattle, stop for 3 days, continue to Ketchikan, take the ferry from there to Juneau, continue from Juneau 4 days later to Anchorage, stay a week, return from Anchorage to Seattle, take the train to Portland, and then continue 2 days later to Los Angeles on a flight that connects in San Francisco. The whole itinerary would cost 30,000 Asia Miles, which is the same number of points as if you booked with Alaska Airlines Mileage Plan and fully optimized your stopovers.

You can’t book this kind of itinerary online. Instead, you have to call in and work with the Asia Miles call center. Note that the Asia Miles program is very complicated and it can take a long time for agents to review the rules and ensure that your booking confirms. Some agents will claim you can’t do something that is actually allowed (they apparently get in a lot of trouble if they make any mistakes), so it’s best to hang up and call again if you know you’re in the right.

Programs I Avoid

Not every Alaska partner offers good value when redeeming their points for flights on Alaska Airlines. Here are the programs I generally avoid:

American Airlines AAdvantage

American Airlines makes very few seats on American flights available in their program. It is not a program I generally recommend accumulating miles in because the award chart has frequently devalued and the miles have become very difficult to spend.

Because of this, it might be tempting to spend your AAdvantage miles on an Alaska Airlines flight, especially because it’s so easy: Alaska flights are bookable on the American Airlines Web site. However, American Airlines offers generally poor value for these flights because their award chart is expensive. Domestic flights on Alaska Airlines cost 12,500 AAdvantage miles each way. Flights to Hawaii cost 22,500 AAdvantage miles each way. No stopovers are allowed.

The upside is that you can mix in Alaska flights with other flights to create a complete AAdvantage award itinerary. This can be a good deal if it helps you connect up with an American or other partner flight to your final destination. However, for an itinerary that strictly includes flights on Alaska Airlines, the award chart is only competitive for long, cross-country flights.

LATAM Pass

On paper, this distance-based award program has some really nice sweet spots. Check out their chart. They are particularly sweet for short distance intra-Alaska redemptions under 350 miles round-trip such as between Petersburg and Wrangell or Juneau and Glacier Bay. These cost only 3,750 points each way.

The problem is fees, the complexity of booking, and the complexity of earning points:

- There is a $30 fee to redeem awards when booked over the phone, and this is not waived for airlines (like Alaska) that aren’t bookable online.

- You have to book round-trip. Prices shown in the chart are each way based on round-trip purchase.

- The LATAM Pass call center only operates in the Spanish language. If you need to do business in English, there is a complicated process to call in and request a call-back. This can take up to two days to arrange.

- The service center books so few flights on Alaska that they may tell you outright that it isn’t possible (that’s what they told me, in writing!). It actually is, you just have to be persistent.

- The only practical way to earn LATAM Pass points, apart from flying, is with their co-branded credit card. Unfortunately the card just isn’t very good.

Air France/KLM Flying Blue

Not only are the redemption rates relatively unattractive, you can’t book Alaska Airlines flights on the Flying Blue Web site. It requires dealing with their call center, which is based in Mexico. Additionally, this partnership ends in April, which means that you won’t be able to make any changes to tickets booked for travel after then.

Emirates Skywards

Redemption rates are unattractive using this program. If you’re stuck with Emirates points, Alaska Airlines flights are a great way (and in fact, one of the only ways) to redeem them with no fuel surcharges. However, you shouldn’t transfer points into this program to book flights on Alaska Airlines.

Qantas

Same story as Emirates: Redemption rates are unattractive using this program. If you’re stuck with Qantas points, Alaska Airlines flights are a great way to redeem them with no fuel surcharges. However, you shouldn’t transfer points into this program to book flights on Alaska Airlines.

Wrap-Up

Alaska Airlines goes more places than ever before, and has relatively generous award availability on their own flights. This is particularly true if you’re based in the former Virgin America hubs of Dallas and San Francisco, or the new mini-hub of San Diego. However, the best award pricing often requires using a partner program and booking over the phone.