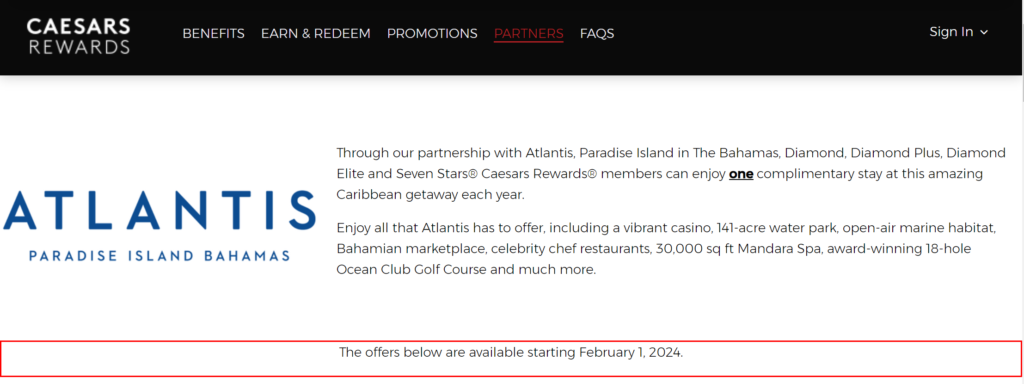

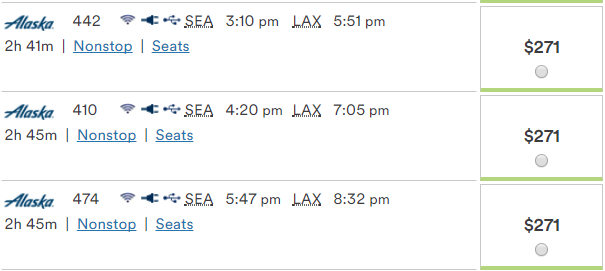

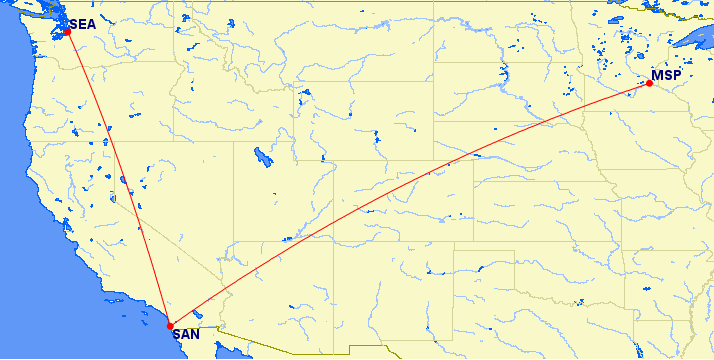

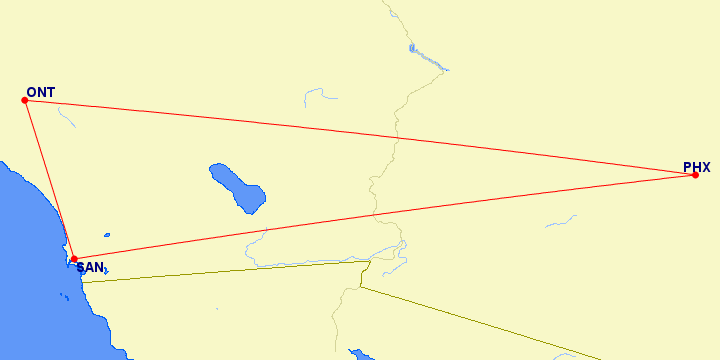

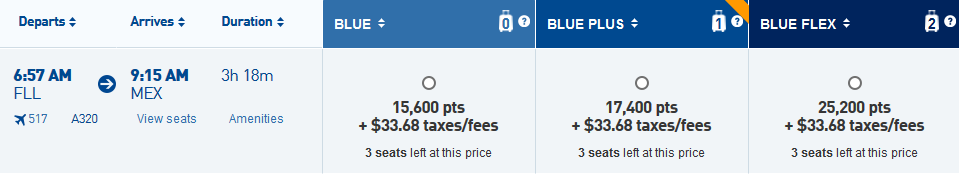

It’s well-known that the closer to the travel date you buy your trip, the more your ticket usually costs. This is because business travel often occurs on short notice and last-minute travel is rarely optional. Accordingly, airlines are able to charge a premium, and they shamelessly do so. A flight from Seattle to Los Angeles may cost well over $200 when purchased on short notice. Here are some example Alaska flights leaving from Seattle tomorrow:

Flying to LAX tomorrow? That’ll be $271. Ouch!

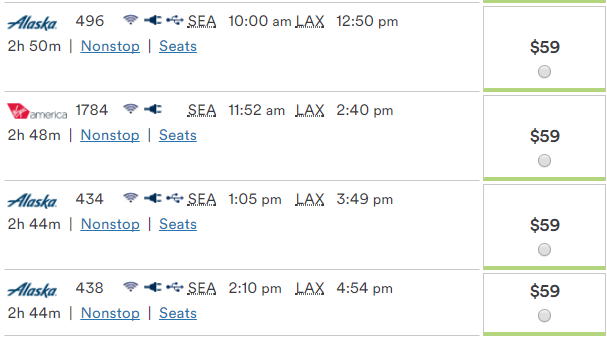

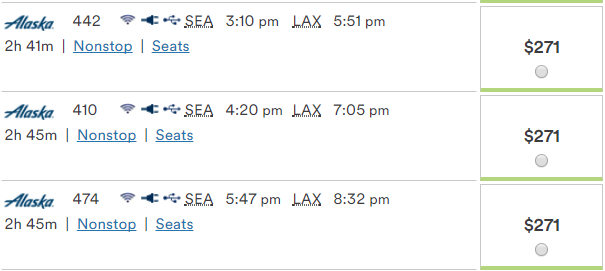

Meanwhile, if you book 3 weeks in advance, the fare can be as little as $59:

This fare is so cheap that it’s a no-brainer to pay cash.

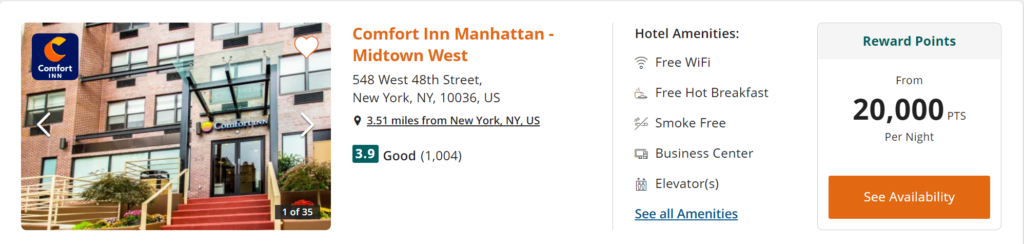

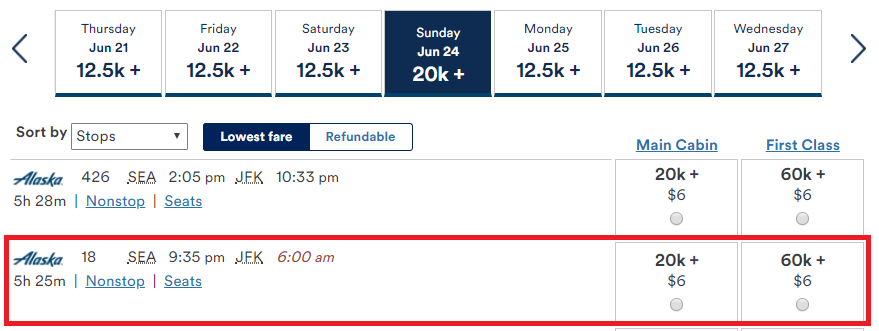

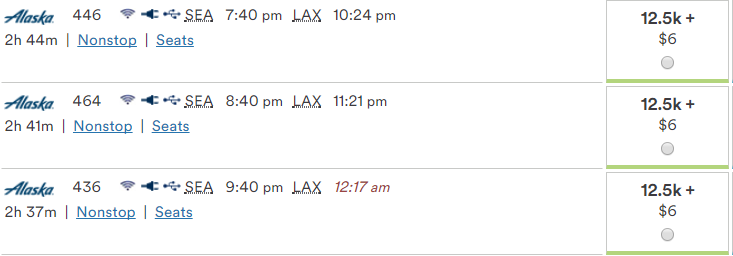

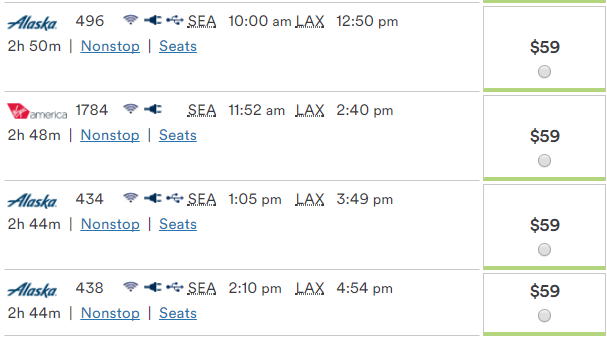

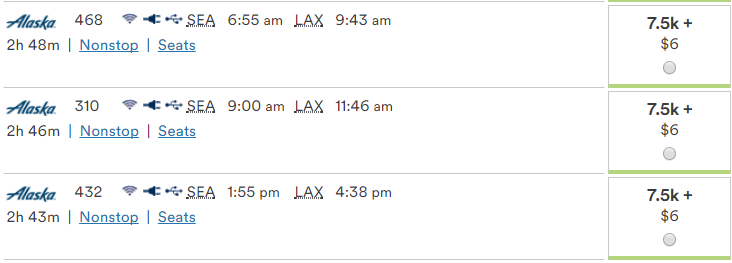

For a long time, the pricing of flight awards was entirely disconnected from the supply-and-demand dynamics in play. Award inventory hung out on its own, and the pricing remained the same whether you were booking 330 days in advance or on the day of travel. This is no longer the case with all airlines. Sticking with an Alaska flight from Seattle to Los Angeles as an example, here’s what the pricing looks like if you travel tomorrow:

12,500 points is the highest saver pricing level for Alaska domestic economy class award flights.

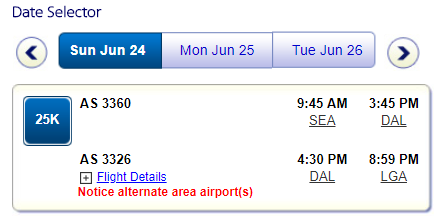

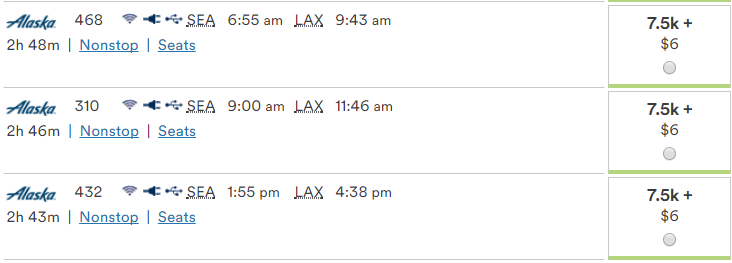

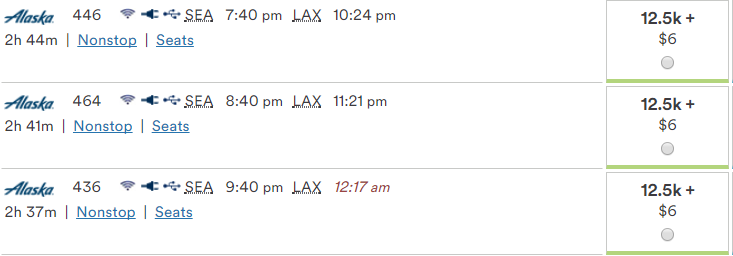

Meanwhile, if you book in advance, the pricing can look a lot different:

Booking in advance? The pricing is a lot lower–in this case, 40% lower!

Alaska and Delta change the price of flights depending on how far in advance you book your flight. It’s always cheapest if you book 3 weeks or more in advance and in the example above, it’s 40% cheaper to do this.

With Delta, the close-in booking price goes up for both their own flights and for partner flights. However, with Alaska, the close-in booking price only goes up for their own flights. However, unlike Delta, Alaska publishes an award chart showing the price range so you always know the maximum price of an award flight in the class of service you’re booking.

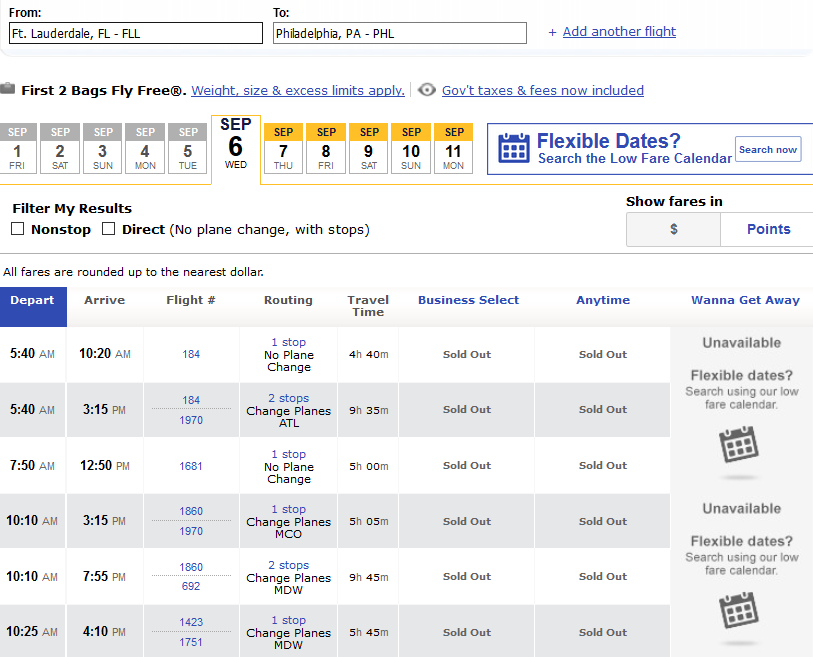

American and United don’t adjust the pricing of awards. Instead, they charge a $75 close-in booking fee if you don’t book 21 days in advance. Naturally, both airlines make last-minute award seats available inside of 21 days in advance, presumably so they can maximize booking fees.

My Favorite Programs For Last-Minute Flights

When I’m booking award flights at the last minute, I have two occasionally conflicting objectives: minimizing fees and using the fewest number of points. Sometimes, an award with fewer fees costs more points. So, this becomes a question of not just finding an award flight, but both optimizing the award program I use to book the flight and balancing points redeemed versus cash spent.

You may not be familiar with these award programs, but it’s possible that you have points you can transfer into them. There are plenty of other articles on the Internet about transferable points (Starwood, Citi ThankYou Points, Chase Ultimate Rewards and American Express Membership Rewards) so there’s no point in rehashing these here.

Aeroplan: This mileage program, affiliated with Air Canada, gives you access to United flights with no last-minute booking fees or higher prices for last-minute bookings. Aeroplan also charges lower award prices than many airlines. The downside is that Aeroplan passes along fuel surcharges. These aren’t charged on United flights, but are charged on a lot of other airlines, such as Lufthansa and Air Canada (Aeroplan is, believe it or not, a poor choice of program for booking Air Canada flights). For airlines such as these, Avianca LifeMiles is a better alternative.

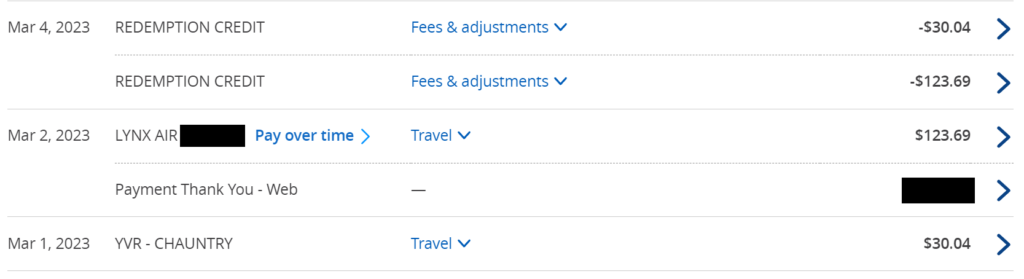

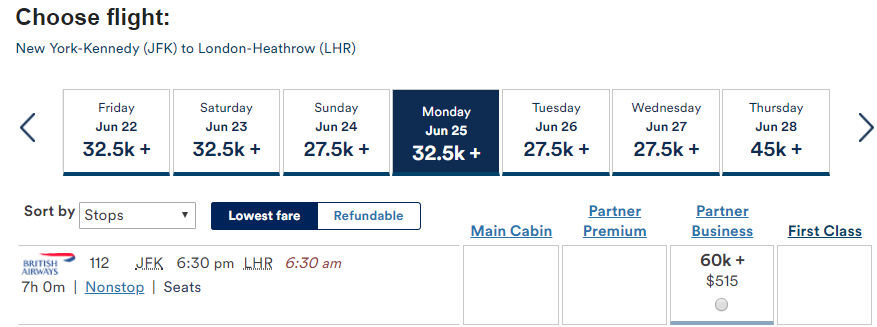

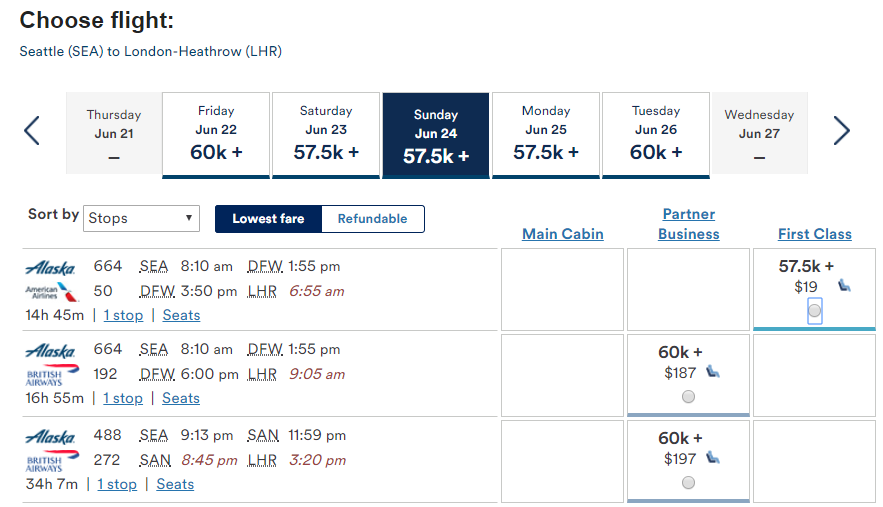

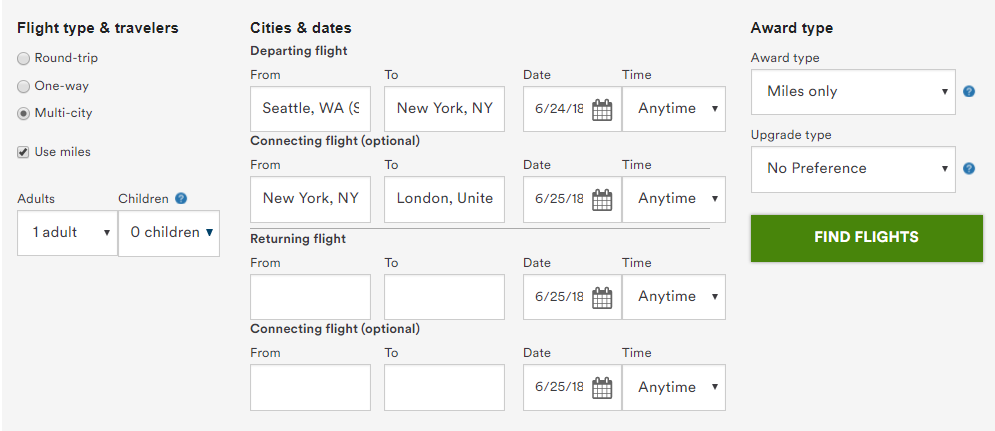

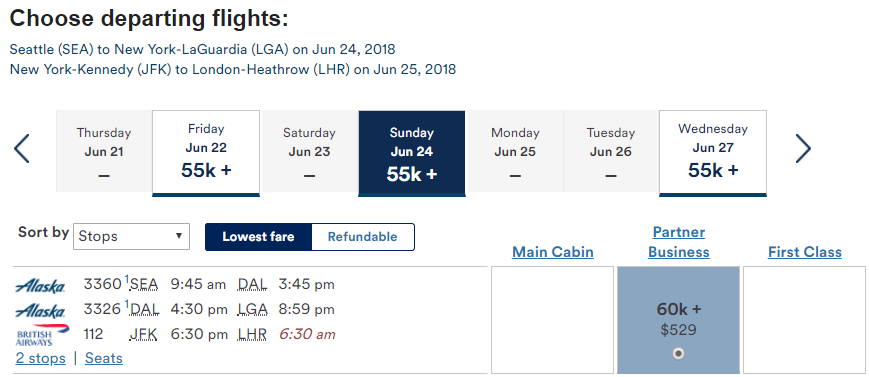

Alaska Airlines Mileage Plan: Need an award flight on American Airlines? Alaska will charge you a partner booking fee of $12.50 each way, but this sure beats the $75 last-minute booking fee charged by American. You can also book American partners British Airways, Cathay Pacific and (soon) Finnair with Alaska Airlines Mileage Plan miles.

Avianca LifeMiles: I hesitate to recommend this program for last-minute bookings because the Web site often has technical errors, and the complicated manual workarounds required when this happens take several days. However, if the Web site does in fact work, there are no last-minute booking fees, no fuel surcharges, and attractive redemption rates for United and other StarAlliance flights (such as Air Canada). Why bother? Well, why not, if you have nothing to lose?

British Airways Avios: This program is particularly good for booking award flights on Alaska Airlines and American Airlines. If you’re booking at the last minute and your flight doesn’t involve a connection, the pricing for these flights can be less than with the airlines’ own programs. There is also no last-minute booking fee. Note that award tickets are charged per flight and based on distance, so connecting flights are often much more expensive in terms of points than with the programs of partner airlines. Long-haul flights also tend to be expensive, especially in premium cabins.

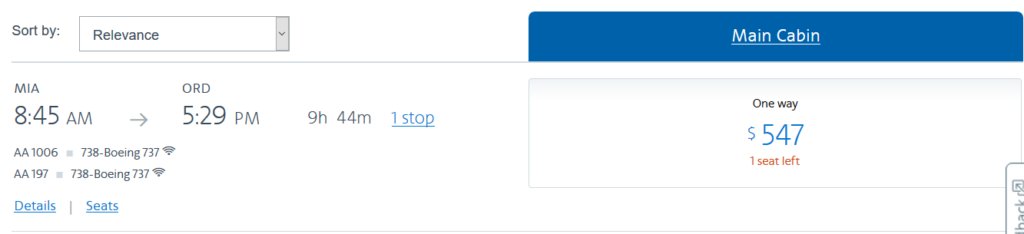

Flying Blue (Air France/KLM): This is a great way to avoid Delta’s higher mileage rates when booking at the last minute. Award pricing is similar to Delta’s “old” award chart, which is less expensive than today’s pricing. There are no last-minute booking fees. Note that unlike Delta, Flying Blue passes along fuel surcharges on Air France/KLM flights. These can be substantial so be sure to crunch the numbers when considering the cash versus points cost of a trip.

Hawaiian: While the Hawaiian award chart is more expensive than most, availability is relatively generous for last-minute flights to Hawaii.

jetBlue TrueBlue: Except for partner flights on Hawaiian (for which using HawaiianMiles is generally a better deal), jetBlue charges based on the price of a flight. Although this is rarely a great deal for last-minute flights, you can sometimes get better value booking with TrueBlue points than using bank points towards a cash fare via a travel portal.

Singapore KrisFlyer: Another way to make last-minute bookings on Alaska Airlines or United at attractive redemption rates and no booking fees. The downside is that this must be done over the phone, and points don’t transfer immediately (but typically do transfer on the same day).

Southwest: This program charges based on the cash cost of a ticket. However, unlike many other airlines, Southwest sometimes has cheap fares right up until the last minute. It’s always worth checking Southwest if they fly a route you want to take, and you’ll almost always get better value out of Southwest points than you will using a bank’s travel portal.

Programs To Avoid For Last-Minute Flights

Some programs look good on paper for last-minute bookings because they don’t charge last-minute booking fees or higher redemption rates, but these are ones that I typically avoid:

Aeromexico: This program has unattractive redemption rates and a reputation for poor customer service. It also takes nearly a week for points to transfer into it.

ANA: Points transfers take several days, so this program isn’t useful for last-minute bookings unless you already have ANA Mileage Club points.

AsiaMiles: Points transfers take at least 24 hours, so this program isn’t useful for last-minute bookings unless you already have AsiaMiles. If you do, this program is useful for booking flights on Alaska and American without last-minute booking fees, although the redemption rates are typically higher than you would pay with either program.

Korean Air: This program requires partner awards to be booked round-trip, and the booking process for partner awards is very complicated requiring multiple phone calls and even the occasional fax. It’s a great program for specific “sweet spot” bookings when you can find availability and meet all the requirements, but it’s not good to use for last-minute award seats.

Iberia: This program won’t allow you to book less than 24 hours in advance even though availability is shown. Also, round-trip bookings are required.

Emirates Skywards: High redemption rates and the complexity of redemptions make this program a good one to avoid.

Wrap-Up

When you need to take a trip at the last minute, don’t just look for award availability in the program of the operating airline. Booking through a partner airline could save you both points and money!